All Categories

Featured

Table of Contents

- – How can an Annuity Interest Rates protect my r...

- – Where can I buy affordable Secure Annuities?

- – What are the top Retirement Income From Annui...

- – How do I choose the right Annuity Interest Ra...

- – How does an Immediate Annuities help with re...

- – How long does an Retirement Annuities payout...

Note, nevertheless, that this doesn't claim anything about adjusting for rising cost of living. On the bonus side, even if you think your alternative would certainly be to purchase the securities market for those 7 years, and that you would certainly get a 10 percent annual return (which is far from particular, particularly in the coming years), this $8208 a year would certainly be even more than 4 percent of the resulting nominal supply worth.

Instance of a single-premium deferred annuity (with a 25-year deferment), with 4 repayment alternatives. Politeness Charles Schwab. The month-to-month payout below is highest possible for the "joint-life-only" choice, at $1258 (164 percent higher than with the instant annuity). The "joint-life-with-cash-refund" choice pays out just $7/month less, and guarantees at least $100,000 will be paid out.

The method you purchase the annuity will establish the response to that inquiry. If you acquire an annuity with pre-tax bucks, your premium reduces your taxable income for that year. Nonetheless, eventual payments (regular monthly and/or round figure) are taxed as routine revenue in the year they're paid. The benefit below is that the annuity may allow you postpone taxes past the IRS contribution limits on Individual retirement accounts and 401(k) plans.

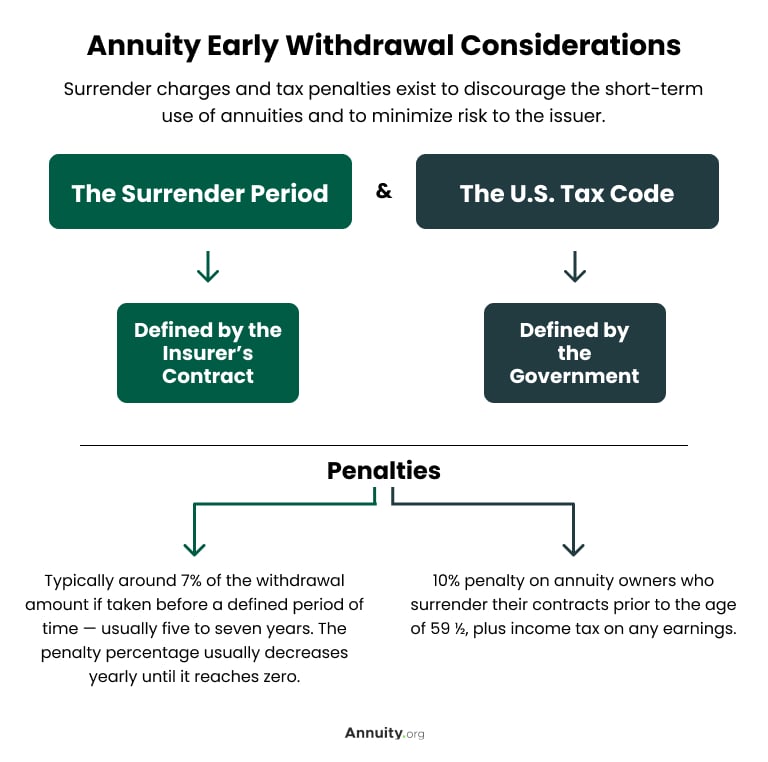

According to , buying an annuity inside a Roth strategy causes tax-free repayments. Purchasing an annuity with after-tax dollars outside of a Roth leads to paying no tax on the section of each payment credited to the initial costs(s), however the staying portion is taxed. If you're establishing up an annuity that starts paying before you're 59 years old, you might have to pay 10 percent very early withdrawal fines to the internal revenue service.

How can an Annuity Interest Rates protect my retirement?

The consultant's very first action was to develop an extensive financial prepare for you, and after that discuss (a) exactly how the suggested annuity fits right into your general plan, (b) what alternatives s/he considered, and (c) exactly how such choices would certainly or would not have led to lower or greater payment for the advisor, and (d) why the annuity is the superior choice for you. - Annuity accumulation phase

Obviously, an expert might attempt pushing annuities also if they're not the very best fit for your scenario and objectives. The reason could be as benign as it is the only item they market, so they drop prey to the typical, "If all you have in your tool kit is a hammer, quite quickly every little thing begins appearing like a nail." While the expert in this scenario may not be underhanded, it enhances the danger that an annuity is an inadequate option for you.

Where can I buy affordable Secure Annuities?

Considering that annuities often pay the agent offering them much greater payments than what s/he would certainly get for investing your money in mutual funds - Fixed-term annuities, let alone the zero compensations s/he would certainly obtain if you invest in no-load common funds, there is a big incentive for representatives to push annuities, and the extra challenging the far better ()

An unscrupulous advisor suggests rolling that quantity right into brand-new "far better" funds that just take place to carry a 4 percent sales load. Consent to this, and the consultant pockets $20,000 of your $500,000, and the funds aren't likely to carry out far better (unless you selected much more improperly to start with). In the same example, the expert might guide you to buy a complicated annuity with that said $500,000, one that pays him or her an 8 percent compensation.

The consultant tries to rush your choice, asserting the offer will certainly soon go away. It may undoubtedly, however there will likely be equivalent offers later on. The advisor hasn't figured out how annuity payments will certainly be taxed. The expert hasn't revealed his/her compensation and/or the costs you'll be charged and/or hasn't revealed you the effect of those on your ultimate repayments, and/or the compensation and/or fees are unacceptably high.

Your family members history and existing wellness indicate a lower-than-average life expectancy (Annuity income). Existing rate of interest prices, and thus forecasted repayments, are traditionally low. Also if an annuity is ideal for you, do your due persistance in comparing annuities offered by brokers vs. no-load ones marketed by the releasing business. The latter may require you to do more of your very own research study, or use a fee-based monetary expert who may get compensation for sending you to the annuity issuer, however might not be paid a greater commission than for various other financial investment choices.

What are the top Retirement Income From Annuities providers in my area?

The stream of regular monthly repayments from Social Safety is comparable to those of a postponed annuity. A 2017 comparative analysis made a thorough comparison. The adhering to are a few of one of the most salient points. Considering that annuities are voluntary, individuals getting them normally self-select as having a longer-than-average life span.

Social Protection benefits are completely indexed to the CPI, while annuities either have no inflation security or at many supply an established portion yearly increase that may or may not compensate for inflation completely. This kind of biker, similar to anything else that increases the insurance company's danger, needs you to pay more for the annuity, or approve reduced repayments.

How do I choose the right Annuity Interest Rates for my needs?

Disclaimer: This post is intended for informative functions just, and must not be taken into consideration financial guidance. You should consult an economic professional prior to making any significant economic choices. My job has actually had several unpredictable weave. A MSc in academic physics, PhD in speculative high-energy physics, postdoc in fragment detector R&D, study setting in experimental cosmic-ray physics (including a number of brows through to Antarctica), a short stint at a tiny design services business supporting NASA, adhered to by beginning my own tiny consulting technique supporting NASA jobs and programs.

Given that annuities are planned for retired life, taxes and penalties may apply. Principal Protection of Fixed Annuities. Never ever shed principal as a result of market performance as fixed annuities are not purchased the market. Even during market downturns, your money will not be affected and you will certainly not shed money. Diverse Financial Investment Options.

Immediate annuities. Deferred annuities: For those who desire to grow their cash over time, however are prepared to defer accessibility to the money up until retired life years.

How does an Immediate Annuities help with retirement planning?

Variable annuities: Provides greater potential for growth by spending your money in financial investment choices you select and the ability to rebalance your portfolio based upon your choices and in a manner that aligns with altering economic objectives. With taken care of annuities, the firm invests the funds and offers a rate of interest to the customer.

When a fatality insurance claim accompanies an annuity, it is essential to have actually a called beneficiary in the agreement. Various choices exist for annuity fatality advantages, depending on the contract and insurance firm. Choosing a refund or "period certain" alternative in your annuity provides a fatality advantage if you die early.

How long does an Retirement Annuities payout last?

Calling a recipient other than the estate can help this process go more smoothly, and can aid guarantee that the earnings go to whoever the specific desired the cash to go to instead than going through probate. When existing, a fatality benefit is automatically included with your contract.

Table of Contents

- – How can an Annuity Interest Rates protect my r...

- – Where can I buy affordable Secure Annuities?

- – What are the top Retirement Income From Annui...

- – How do I choose the right Annuity Interest Ra...

- – How does an Immediate Annuities help with re...

- – How long does an Retirement Annuities payout...

Latest Posts

Decoding How Investment Plans Work A Closer Look at How Retirement Planning Works Breaking Down the Basics of Fixed Index Annuity Vs Variable Annuities Pros and Cons of Various Financial Options Why F

Understanding Financial Strategies A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Variable Annuities Vs Fixed An

Analyzing Strategic Retirement Planning Key Insights on Fixed Income Annuity Vs Variable Growth Annuity What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans W

More

Latest Posts