All Categories

Featured

Table of Contents

On the various other hand, if a client needs to offer an unique needs child that might not have the ability to manage their own cash, a trust fund can be included as a recipient, allowing the trustee to manage the circulations. The sort of beneficiary an annuity owner picks impacts what the recipient can do with their acquired annuity and just how the profits will certainly be tired.

Lots of agreements allow a partner to identify what to do with the annuity after the proprietor dies. A partner can transform the annuity contract into their name, presuming all regulations and rights to the initial contract and postponing immediate tax obligation effects (Annuity payout options). They can gather all staying payments and any survivor benefit and select recipients

When a partner ends up being the annuitant, the spouse takes over the stream of settlements. Joint and survivor annuities additionally allow a named beneficiary to take over the contract in a stream of settlements, instead than a lump amount.

A non-spouse can just access the assigned funds from the annuity proprietor's initial contract. Annuity owners can select to designate a depend on as their recipient.

Why is an Deferred Annuities important for my financial security?

These differences assign which recipient will obtain the whole death advantage. If the annuity proprietor or annuitant dies and the main beneficiary is still alive, the main beneficiary receives the survivor benefit. Nonetheless, if the main recipient predeceases the annuity owner or annuitant, the survivor benefit will most likely to the contingent annuitant when the owner or annuitant passes away.

The owner can alter beneficiaries any time, as long as the agreement does not call for an irreversible beneficiary to be called. According to expert contributor, Aamir M. Chalisa, "it is essential to understand the significance of marking a beneficiary, as choosing the wrong recipient can have significant repercussions. A number of our customers pick to call their underage children as beneficiaries, typically as the primary recipients in the absence of a partner.

Proprietors that are wed should not assume their annuity immediately passes to their partner. Frequently, they go via probate. Our brief quiz offers quality on whether an annuity is a wise choice for your retired life portfolio. When picking a recipient, think about variables such as your relationship with the person, their age and just how inheriting your annuity may influence their monetary circumstance.

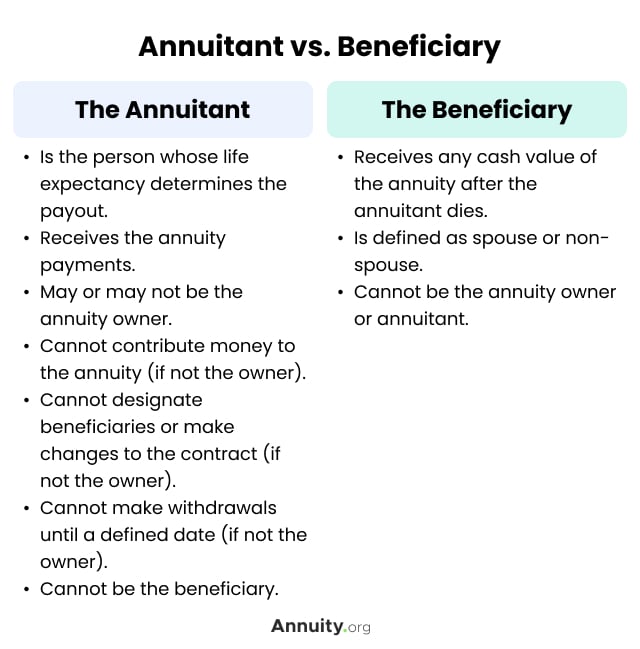

The recipient's partnership to the annuitant normally identifies the guidelines they follow. For instance, a spousal beneficiary has more options for taking care of an acquired annuity and is treated more leniently with taxes than a non-spouse beneficiary, such as a youngster or other family members participant. Annuity payout options. Mean the owner does determine to call a kid or grandchild as a beneficiary to their annuity

Who has the best customer service for Annuity Interest Rates?

In estate preparation, a per stirpes classification specifies that, should your beneficiary die prior to you do, the beneficiary's descendants (children, grandchildren, et cetera) will obtain the death advantage. Connect with an annuity expert. After you've chosen and named your beneficiary or beneficiaries, you should proceed to review your options a minimum of as soon as a year.

Maintaining your classifications up to day can make sure that your annuity will be managed according to your dreams need to you pass away suddenly. A yearly evaluation, major life occasions can motivate annuity proprietors to take one more appearance at their beneficiary choices.

Can I get an Annuities For Retirement Planning online?

Similar to any type of financial product, looking for the assistance of an economic advisor can be beneficial. An economic coordinator can direct you with annuity management procedures, including the approaches for updating your contract's recipient. If no beneficiary is called, the payout of an annuity's fatality advantage mosts likely to the estate of the annuity owner.

To make Wealthtender totally free for viewers, we generate income from advertisers, consisting of economic experts and firms that pay to be featured. This produces a problem of rate of interest when we prefer their promotion over others. Read our editorial plan and regards to solution to learn much more. Wealthtender is not a client of these monetary providers.

As a writer, it is just one of the ideal praises you can provide me. And though I actually appreciate any one of you spending some of your hectic days reading what I compose, slapping for my post, and/or leaving praise in a remark, asking me to cover a topic for you really makes my day.

It's you claiming you trust me to cover a topic that is necessary for you, and that you're positive I would certainly do so better than what you can currently locate on the Internet. Pretty heady stuff, and a duty I don't take likely. If I'm not familiar with the topic, I research it online and/or with calls who know even more about it than I do.

Who should consider buying an Senior Annuities?

Are annuities a legitimate suggestion, an intelligent relocation to protect surefire income for life? In the most basic terms, an annuity is an insurance coverage item (that just certified representatives may offer) that guarantees you regular monthly payments.

This typically uses to variable annuities. The even more cyclists you tack on, and the less threat you're ready to take, the lower the repayments you must anticipate to receive for a provided costs.

Annuity Riders

Annuities picked properly are the appropriate choice for some people in some situations. The only method to understand for certain if that includes you is to initially have a comprehensive financial strategy, and then find out if any annuity choice provides enough advantages to justify the expenses. These costs include the bucks you pay in costs obviously, however likewise the possibility cost of not investing those funds in different ways and, for much of us, the influence on your ultimate estate.

Charles Schwab has an awesome annuity calculator that reveals you around what settlements you can get out of fixed annuities. I used the calculator on 5/26/2022 to see what an immediate annuity may payout for a solitary premium of $100,000 when the insured and spouse are both 60 and reside in Maryland.

Table of Contents

Latest Posts

Decoding How Investment Plans Work A Closer Look at How Retirement Planning Works Breaking Down the Basics of Fixed Index Annuity Vs Variable Annuities Pros and Cons of Various Financial Options Why F

Understanding Financial Strategies A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Variable Annuities Vs Fixed An

Analyzing Strategic Retirement Planning Key Insights on Fixed Income Annuity Vs Variable Growth Annuity What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans W

More

Latest Posts